Google's Massive CapEx Increase Signals Major AI and Cloud Push Following Strong Earnings

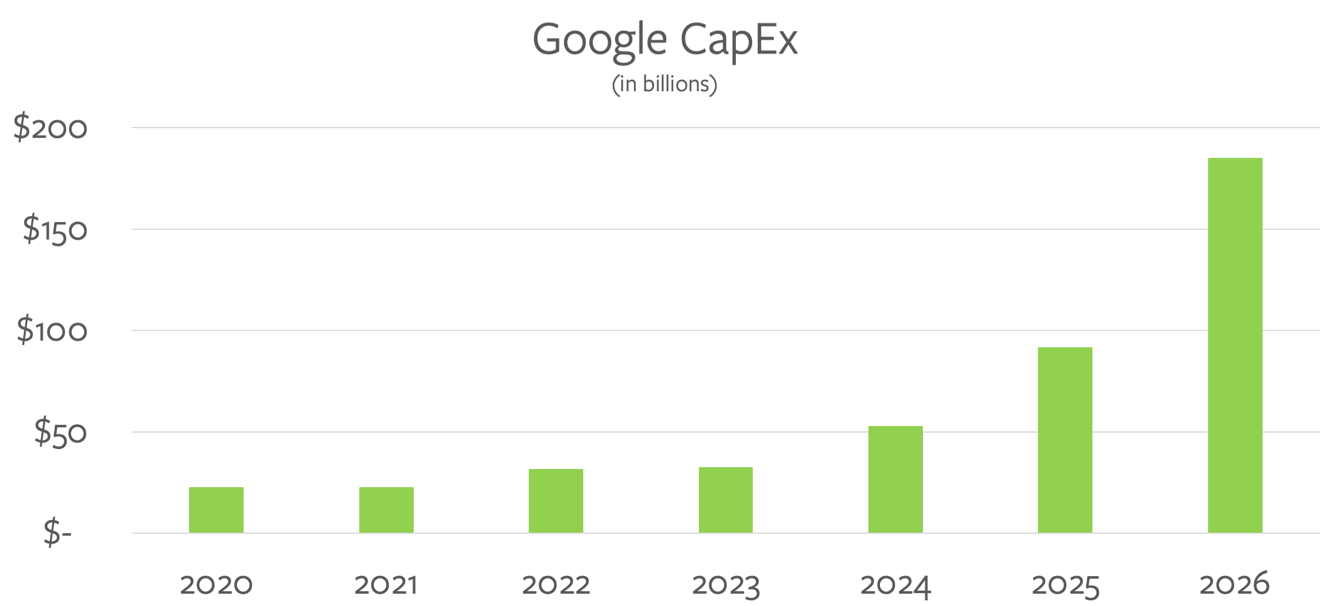

Google has announced a substantial increase in capital expenditures (CapEx), surprising industry observers and signaling a strategic acceleration in key areas. While the exact figures are proprietary, the magnitude of the increase suggests a significant investment beyond routine infrastructure maintenance and upgrades.

This CapEx surge is directly tied to Google's ambitions in two primary sectors: Google Cloud and advancements in artificial intelligence. Google Cloud is engaged in a fierce battle for market share with Amazon Web Services (AWS) and Microsoft Azure, and the additional capital will likely be used to expand data center capacity, improve service offerings, and enhance overall cloud infrastructure.

Moreover, Google is deeply invested in the development and deployment of large language models (LLMs). These powerful AI models, which power Bard (now Gemini) and other Google services, require substantial computational resources for training and inference. The CapEx increase will facilitate the acquisition of advanced hardware, including specialized processors and memory, to support the ongoing development and refinement of these AI technologies.

The earnings report provides clear justification for this aggressive investment strategy. Google's search advertising revenue remains a powerful engine for growth, and the company is successfully integrating AI into its search products to enhance user experience and drive engagement. The robust performance of Google Cloud also contributes to the overall financial picture, indicating a healthy demand for Google's cloud services.

The implications of this CapEx increase are far-reaching. It suggests that Google is committed to maintaining its leadership position in search and AI, and it is willing to invest heavily to achieve this goal. The increased spending could also intensify competition in the cloud market, potentially leading to lower prices and improved services for consumers and businesses. Furthermore, it reflects confidence in the long-term potential of AI and its transformative impact on various industries.

However, the increased CapEx also carries some risks. Overspending on infrastructure could negatively impact profitability if revenue growth does not keep pace. Moreover, the rapid pace of technological change means that Google must carefully manage its investments to ensure that they align with evolving market demands and emerging AI paradigms.

In conclusion, Google's massive CapEx increase is a bold move that reflects its commitment to innovation and growth. By investing heavily in cloud infrastructure and AI, Google is positioning itself to capitalize on the transformative potential of these technologies and maintain its competitive edge in the years to come. The impact of these investments will be closely watched by investors, competitors, and the broader tech industry.

David Kim

Business CorrespondentAnalyzing market trends and corporate strategies. detailed insights into the business world.

Read Also

Crypto.com Pioneers AI in Digital Assets with Key Certification and AI Agent Platform Launch

Crypto.com is making a bold move into the artificial intelligence space, solidifying its commitment by becoming the first digital asset platform to achieve ISO/IEC 42001:2023 certification for AI systems management. This achievement coincides with the launch of ai.com, a platform designed to empower users with customizable AI agents capable of handling diverse tasks, including crypto trading and workflow automation.

Unitree's Humanoid Robots Showcase Martial Arts Prowess in Dazzling Chinese New Year Performance

Boston Dynamics isn't the only one with dancing robots anymore. Unitree Robotics' impressive line of humanoid robots recently demonstrated their agility and coordination with a choreographed martial arts routine during Chinese New Year celebrations, showcasing advancements in robotics and AI control.

Andreessen Horowitz Bets Big on European AI, Leading $2.3M Pre-Seed Round for Swedish Dental Tech Startup Dentio

Andreessen Horowitz (a16z) is actively scouting Europe for the next big thing, as evidenced by their recent lead in a $2.3 million pre-seed round for Dentio, a Swedish startup leveraging AI to streamline administrative tasks for dental practices. This investment signals a larger trend of U.S. venture capital firms looking beyond Silicon Valley for promising innovation and untapped markets. Partner Gabriel Vasquez's extensive travel to Stockholm underscores a16z's commitment to identifying and ba

Flapping Airplanes: AI Startup Takes Flight with $180M to Reimagine Machine Learning

Flapping Airplanes, a newly launched AI research lab, is challenging the conventional wisdom of massive data-hungry AI models. Armed with $180 million in seed funding, the company aims to develop more data-efficient AI by drawing inspiration from the human brain and exploring radically different approaches to machine learning. Can this innovative startup revolutionize the future of artificial intelligence?