Stratechery's Weekly Roundup: TSMC Risk Analysis Headlines This Week's Insights

This Week in Stratechery, the weekly newsletter summarizing the content within the Stratechery bundle, featured a video analysis on the risks associated with TSMC, the world's leading semiconductor manufacturer. While the original newsletter briefly mentions content highlights, the significance of focusing on TSMC warrants further elaboration. TSMC's dominance in chip fabrication makes it a critical player in the global technology landscape. Understanding the risks facing TSMC is crucial for anyone involved in the tech industry, from investors to component buyers.

The risks facing TSMC are multifaceted. Geopolitical tensions, particularly between China and Taiwan, represent a significant threat. Any disruption to TSMC's operations would have cascading effects on industries that rely on its chips, including smartphones, automobiles, and data centers. The concentration of manufacturing in a single geographic location amplifies this risk. Furthermore, the advanced nature of chip manufacturing requires enormous capital investment, sophisticated technology, and a highly skilled workforce. Maintaining its technological lead and competing effectively requires constant innovation and adaptation.

Cybersecurity threats also pose a considerable risk to TSMC. A successful cyberattack could compromise sensitive intellectual property, disrupt production, and damage the company's reputation. The complexity of modern chip manufacturing processes makes them vulnerable to sophisticated attacks. Additionally, dependence on key equipment suppliers creates another layer of risk. Delays or disruptions in the supply of critical manufacturing equipment could hinder TSMC's ability to meet customer demand. The video presumably delves deeper into the intricacies of these and other challenges.

The Stratechery analysis likely provides a framework for assessing the potential impact of these risks on the broader technology ecosystem. It’s essential for industry stakeholders to understand these vulnerabilities to develop contingency plans and mitigate potential disruptions. The content highlights the importance of continuous monitoring of the geopolitical landscape, investment in cybersecurity measures, and diversification of supply chains to reduce reliance on single sources.

For those interested in gaining a deeper understanding of the strategic challenges facing the technology industry, subscribing to Stratechery provides access to in-depth analysis and valuable insights. The weekly newsletter serves as a useful digest of the most important content, ensuring that subscribers stay informed about the latest developments and trends.

David Kim

Business CorrespondentAnalyzing market trends and corporate strategies. detailed insights into the business world.

Read Also

C2i Semiconductors Lands $15M to Tackle AI Data Center Power Bottleneck, Promising Massive Efficiency Gains

As the AI boom strains global data center power grids, Indian startup C2i Semiconductors is stepping up with a novel approach to power delivery. Backed by Peak XV Partners in a $15 million Series A round, C2i aims to slash energy waste in data centers with its innovative 'grid-to-GPU' power solutions.

Top Windows Laptops of 2026: Performance, Battery Life, and Design Redefined

The Windows laptop landscape is undergoing a dramatic transformation in 2026, with advancements in processing power, battery efficiency, and design aesthetics. Our comprehensive guide highlights the best Windows laptops available, catering to diverse needs from content creation to gaming and everyday productivity. Discover which models are pushing the boundaries and delivering exceptional user experiences.

Stratechery's Latest Deep Dive: Microsoft's Software Survival Strategy in the Age of AI

Ben Thompson's Stratechery highlights its recent content, including a video analysis of Microsoft's strategic positioning in the ever-evolving software landscape. This week's focus centers on Microsoft's resilience and adaptation, particularly concerning its approach to artificial intelligence and competition.

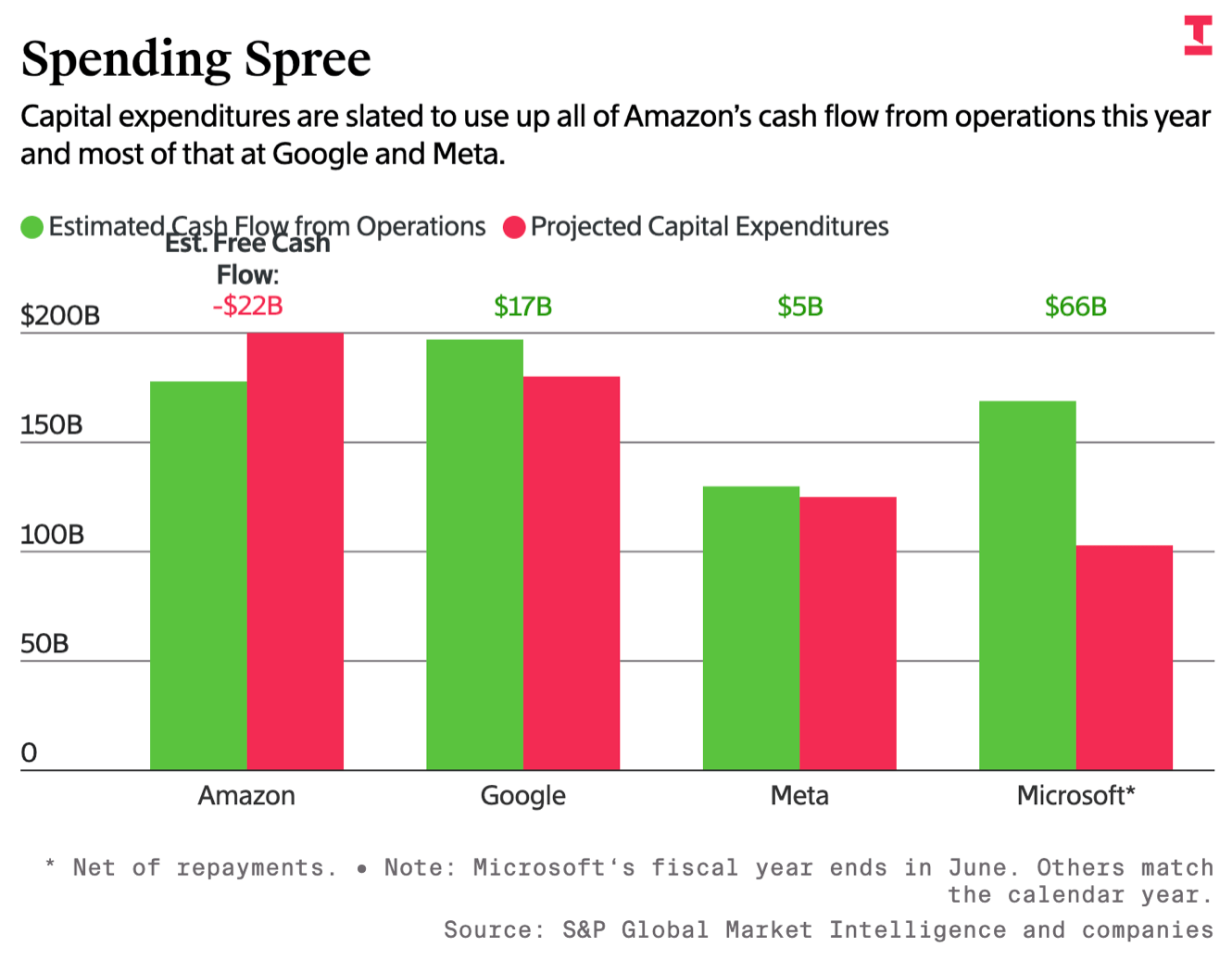

Stratechery Analysis: Amazon's Capital Expenditure Surge Raises Eyebrows Amid AI Investment

Ben Thompson's Stratechery points to Amazon's escalating capital expenditure (CapEx) as a cause for concern, even while acknowledging its potential rationale. This analysis, typically reserved for Stratechery Plus subscribers, hints at a deeper dive into the company's strategic investments, particularly in areas like artificial intelligence and infrastructure.